Soralis Weekly [4/23/24]

Disclaimer: We ourselves are also traders and investors. We also execute on most (if not all) of the plays that we share as alpha. Hence, it could also be assumed that we are holders and have a bag of majority of the projects mentioned below.

Disclaimer: All insights and perspectives shared are of our own. Remember that none of this is to be considered “Financial Advice”. We are not to be held liable for any of your investment decisions.

Broader Market Overview:

$BTC: The halving, an event that only happens every 4 years, has just taken place. So, what is price telling us?

While price deviated from our range of 61k-71k last week, we reclaimed support and we have been holding ever since.

I mostly believed that last week’s dump was simply some pre-halving manipulation and the sell-off wasn’t strong enough to sweep the liquidity at 59k.

A bunch of people were also concerned that the halving would be a “sell the news” event… which is not a great take since majority of crypto-natives are already aware of it and have managed expectations.

While sentiment on the timeline is extremely bullish rn, I’m anticipating more consolidation and chop from here. For the next few weeks at-least.

Sentiment switches to giga-bullish “up only” mode once we break out of this range and the resistance marked in orange.

I’m still open to a sweep of liquidity at 59k, however I find this unlikely as I think <60k will hold strong as structure support from here on out.

I believe this is one of the final “accumulation” ranges for $BTC. The longer it accumulates, the more bullish.

$Total3: Total3 is the entire Crypto Market Cap Excluding $BTC, $ETH. It’s a good indicator of what’s happening to the ALT market.

As this is a higher timeframe, the moves will vary much less on a weekly basis.

As I’ve said last week, Price Discovery only begins once we break ATH. We are currently still a 67% pump away from doing so.

Similar to $BTC, Last week’s dump simply looks like deviation from the range, as we have already reclaimed the support and it seems to be holding.

Looks to me as that was the bottom already for $ALTS.

I’m anticipating more consolidation for the coming weeks as well as $BTC continues to gain more strength for the post-halving rally.

Expect liquidity to trickle down to ALTS further down the line after the inevitable Bitcoin pump.

One of the best time to get positioned for ALTS are when $BTC has strength and dominance over the market. Because liquidity ALWAYS ends up trickling down to riskier, and riskier asset classes.

$SEI: One of the strongest performers during the early stages of the bull. Awaiting the catalyst of $SEI V2.

Within a week, our chart has turned from one of the ugliest price-action wise, into one of the BEST r/r trades.

We showed a lot of strength during the pre-halving ALT slaughter as we deviated from the range and broke down support but reclaimed it since.

Clear break of dynamic resistance (gray line). Clear shift in market structure (higher highs). Strong reclaim of support.

It excites me a lot that we’re showing a lot strength during this accumulation stage for $BTC. Especially considering that the word about V2 hasn’t even been spreading like wildfire yet.

The v2 Catalyst alone should be bullish enough. Now adding the bullish price action… I’m totally a buyer.

If you plan to bid, wait for retracements. Remember to buy red and sell green. Nonetheless, make sure you’re well positioned for V2 as it’s estimated to launch in the coming weeks.

$SEIYAN: One of the first memecoins on $SEI. Definitely our “OG”.

I do believe that like $SEI. We have already bottomed out and price has reversed.

We broke through our previous resistance and have now turned it into support (yellow zone). Clear sign of higher highs and higher lows as well.

At a very critical zone at the moment. Will be interesting to see if we have enough strength to break through the dynamic resistance.

If we reject the break-out, we could potentially revisit our support zone (yellow zone) and see some more consolidation.

We’re also seeing a lot of strength here… We’re already up 100+% from the lows. We’re still around 330% away from ATH tho.

Purely Price-Action wise, $SEIYAN looks like an attractive buy here. Especially R/R wise.

^ This doesn’t even factor in the catalyst of $SEI v2 and the liquidity that it will bring.

$MILLI: The fastest dog on $SEI. Used to be called “The People’s Meme”. Is it still true?

After topping out at 9M, the bloody downtrend has finally concluded.

While majority of ALTS and MEMEs went further down last week during the pre-halving manipulation, that wasn’t the case for $MILLI.

I believe we’ve hit a point of seller exhaustion which is why we’ve been seeing some low volume ranging.

I do think that majority of the holder distribution has likely been shaken out, I’m interested to see how strong the current buyers and holders are and how far they can take this.

If you believe in the coin, this will be the best time to buy as we likely have already bottomed out and we are just consolidating from here.

R/R is better than $SEIYAN but $SEIYAN has more strength and volume at the moment. It is up to personal preference on which you choose as they are both beta plays to $SEI.

Both teams are active and have shown strong commitment to the ecosystem. I assume both will do well once the v2 rotation kicks in as well.

Remember that all our memes and jpegs are leveraged bets on the $SEI ecosystem. No rallies will be made if $SEI disappoints. You should bid only if you believe in the future of $SEI.

NFT Market Overview:

Following the mini-run we’ve had from the NFT cycle back in Jan-Feb. Our ecosystem’s volume has still been in a downtrend while waiting for $SEI v2. There’s still a lack of activity and outside buy pressure for our jpegs.

At our January Peak, we managed 3.73M NFT Trading Volume (in USD) in one week. Last week, we only managed 312k.

Our peak in Volume Moving Average was 3.14M (in USD) in a week. Last week, we only managed 100k.

The graphs above are intuitive to read, we came from highs and we have been trending downwards ever since.

I expect volume and activity to pick up once $SEI V2 is priced in and a target date is announced. The graphs tells us that volume, activity and attention is currently low for $SEI NFTs.

Maybe this tells you to be bearish. This tell me that we’re early.

While it’s not the best look to see volume so low, markets move in rotations and the liquidity isn’t with us as of the moment. Rather than being depresso and bearish, view the charts as an opportunity. This is the time to get positioned, this is the time to accumulate.

Warren Buffet and every other trader and investor didn’t get rich by buying tops. They got rich by buying bottoms.

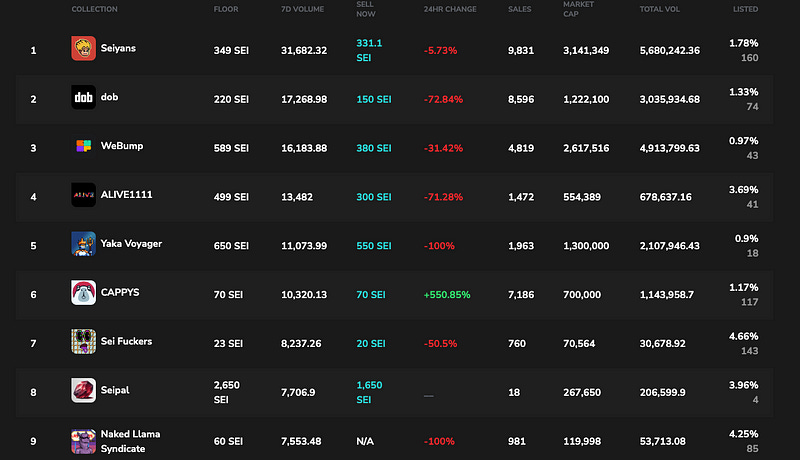

Top Collections still taking up majority of 7D trading volume.

Cappys have pumped 550%. They’ve been staying consistent with their content and the art services they provide to the other projects in the eco.

Seipal has seen some sales this week. They’ve also seen a fair bit of drama.

Naked Llama Syndicate still has a lot of volume as holders anticipate and speculate who the mystery buyer of the project is.

SEI FUCKERS makes it to the top collection projects. They’re an extremely active team who has been showing up on spaces DAILY. 100% will be monitoring this one.

I am not worried despite the lack of activity and volume in our ecosystem. Rotators will eventually find their way to $SEI. The best thing to do now is to place your chips on builders and position yourself for the high influx of liquidity that will come with V2.

SEI Spotlight of the Week

Well-Deserved recognition as well to @AttentionToDe12 for helping us gather some of the data below. He is our main researcher at SoralisIO.

Onchain Orbiters: [Post-Mint]

First OnChain NFT on $SEI.

98 SEI FP. 1101 Supply.

https://www.frensei.io/

Why?

They launched as the first onchain NFT on $SEI. Came from a FREE mint.

Onchain: 100% of the data is stored on the token itself, including the artwork. (Compared to other NFTs that use platforms like Arweave or IPFS to store their data)

^ If you’re a fan of provenance, this is totally the project for you.

They also launched Frensei.io which is an indexer. You’re able to obtain info like Trait Rarity + Holder Ratio.

They’ve also built tools like Raffle + Snapshots. As well as their own launchpad and contract of course.

They mainly focus on launching on-cahin and generative projects. They’ve launched 4 so far.

They’re careful, selective and concious about the projects that they launch. They also do not have set fees or allocation, they decide it based on the projects’ needs and capacity.

They’ve also made a creator portal which enables Mint-Freezing (if issues arise), Post-Mint Reveals (Fun), an easy to use platform for non-devs.

Finally, they built the first fully onchain CW-1155 token on $SEI. Which means 1 NFT distributed to many wallets. (Will have a huge impact on Gaming NFTs on $SEI)

Team: Diddy and Mr. Bread are actual programmers and cybersecurity experts based from the UK. Originally wanted to launch on $ETH but $SEI is (ofcourse) the wiser option.

I’m personally big on provenance so I hold a few simply because of the historical value that it holds. Rotators usually keep provenance in mind too so that’s my thesis with the orbiters.

Team: (Discord)

Founder & Dev — diddybread

Co-Founder & Dev — nft_meat

Socials:

https://www.orbitersnft.com/

https://www.frensei.io/

WarpBois: [Currently Minting]

Infrastructure-heavy project.

10 SEI Mint Price. 1132/4321 Minted.

Ark7, the founder, is an OG in the ecosystem. He’s been building a lot of useful products for NFT traders and collectors here on $SEI.

Trek: Portfolio analytics tool for Tokens and NFTs. You don’t have to connect your wallet,, meaning you can analyse the wallets of other people too. Try it here.

SeiView: Market Analytics, only for warpboi holders. Click here.

SeiSleuth: A more intuitive, easier to use version of SeiScan. ZachXBT would love this. Try here.

All of these tools were built by Ark7. He’s been doing this for awhile and he did it all for free.

Holding a WarpBoi gives you access to his builder community, future premium features, beta access to future products as well.

Low risk play (10 SEI) for access to multiple tools by a respected builder in the space. Could definitely be a move if it is your cup of tea.

Team:

Founder & Dev: https://x.com/ark7dev

Socials:

https://x.com/web3trek

TREK Collection: https://pallet.exchange/collection/trek-access-chit

WARP BOIS MINT LINK: https://www.frensei.io/launchpad/WARP%20BOIS

SEI Relevant News:

SEI v2 coding is now complete.

Blockchain developers and users now have new opportunities as @QuickNode supports @SeiNetwork Mainnet.

A Community Content Creation event with a prize pool in $SEI is being hosted by The SEI Team and @jokerace_io.

The Sei Foundation has proposed the integration of @StargateFinance with Sei V2.

Today marks the launch of the beta version by @AntSwap_.

@Binance Pay has integrated $SEI into its payment platform.

The Sei ecosystem welcomes @nektarnetwork, introducing advanced restaking and Distributed Validator Technology for enhanced security.

@jlyvrs has commenced operations on the V2 Devnet.

@Pallet_Exchange has rolled out the option to bid on individual NFTs or whole collections.

This week’s activity report includes 90.5k transactions, 19.6k active users, over 18.6k swaps, and more than 29k transfers.